kentucky inheritance tax calculator

For any amount over 12500 but not over 25000 then the tax rate is 6 plus 625. The good news is that there are lots of ways to cut down your bill which.

Death And Taxes Nebraska S Inheritance Tax

An inheritance tax is usually paid by a person inheriting an estate.

. The estate tax was enacted in 1936. KRS Chapter 140. Our calculator is a general guide and does not constitute personal advice.

015 Exemption of benefits from federal government arising out of military service. The first 50000 is taxed at 10. The kentucky inheritance tax is a tax on a beneficiarys right to receive property from a deceased person.

In Iowa siblings will pay a 5 tax on any amount over 0 but not over 12500. Ad Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now. Dont leave your 500K legacy to the government.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Its important to calculate and pay these taxes promptly. The KRS database was last updated on 05022022.

Everyone can leave up to 325000 of their total estate free of inheritance tax the nil-rate band provided this allowance hasnt been used when making gifts for example or settling assets into trust. Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand. Kentucky Inheritance and Gift Tax.

The highest property tax rate in the state is in Campbell County at 118 whereas the lowest property tax rate in Kentucky is 056 in Carter County. Inheritance taxes on the other hand are concerned about beneficiaries. The tax is only levied against estates for individuals who have net assets that exceed 117 million for 2021.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. The Kentucky inheritance tax was adopted in 1906 making it the second oldest General Fund tax. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

As you can imagine there are nuances to this tax beyond those which can be explained here. The inheritance tax is not the same as the estate tax. Call an experienced estate planning attorney like Anna M.

Get your free copy of The 15-Minute Financial Plan from Fisher Investments. There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. In fact when the inheritance tax.

Most states do not impose an inheritance tax or an estate tax. The value of all bank and investment accounts. A last will and testament is a document that a person completes.

A persons estate is the sum of their savings investments the market value of the house they live in and their other assets. The state of Kentucky considers a wide range of items taxable including. Inheritance and Estate Taxes are two separate taxes that are often referred to as death taxes since both are occasioned by the death of a property owner.

When a Kentucky resident dies without a last will and testament the intestacy succession laws will dictate who inherits the deceased persons probate estate. Kentuckys revised statutes krs 391035 outlines court procedures for the handling of. If you can manage to pay off the entire inheritance tax prior to nine months passing since the death the Kentucky Department of Revenue will apply a.

The size of the inheritance and the beneficiary. For confirmation of how inheritance tax might affect. Surviving spouses are always exempt.

The inheritance tax in this example is 76670. By way of example if the deceased person was a resident of Kentucky rather than a nonresident who owned property in Kentucky a. Class A beneficiaries pay no taxes on their inheritances.

Our calculator does not cover every nuance of the inheritance tax legislation. Thanks to something called portability this estate tax exemption limit can be increased in many situations. The siblings who inherit will then pay a 11-16 tax rate.

This inheritance tax is only levied against the estates of residents and nonresidents who own property in Kentucky. The most recent change occurred in 1995 when a total exemption. The inheritance tax is not the same as the estate tax.

If you have additional questions about Kentuckys inheritance tax please do. Estimate the value of your estate and how much inheritance tax may be due when you die. Inheritance Estate Tax.

The beneficiary only has to file a tax return if his or her inheritance is considered taxable. For questions or to submit an incentive email the Technical Response ServiceFor additional incentives search the Database of State Incentives for Renewables Efficiency. While they do assess an income tax and of course real estate taxes there is no estate tax.

The last thing a testator wishes to leave his loved ones is an unexpected tax bill. Ad Download Or Email Form 92A200 More Fillable Forms Try for Free Now. It must be filed within 18 months of the individuals death though filing it early has its perks.

Beneficiaries are responsible for paying the inheritance tax. Updated for the 2021-22 tax year. The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money.

The tax to Class C beneficiaries for gifts of that size is calculated at 28670 plus 16 of the amount over 200000. By contrast a nephew in Iowa has a different tax rate. Kentucky does have an inheritance tax.

Includes enactments through the 2021 Special Session. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. The major difference between estate tax and inheritance tax is who pays the tax.

The Kentucky inheritance tax is a tax imposed on certain beneficiaries who inherit property or money from a Kentucky estate. State inheritance tax rates range from 1 up to 16. As a result it will not be assessed against many folks.

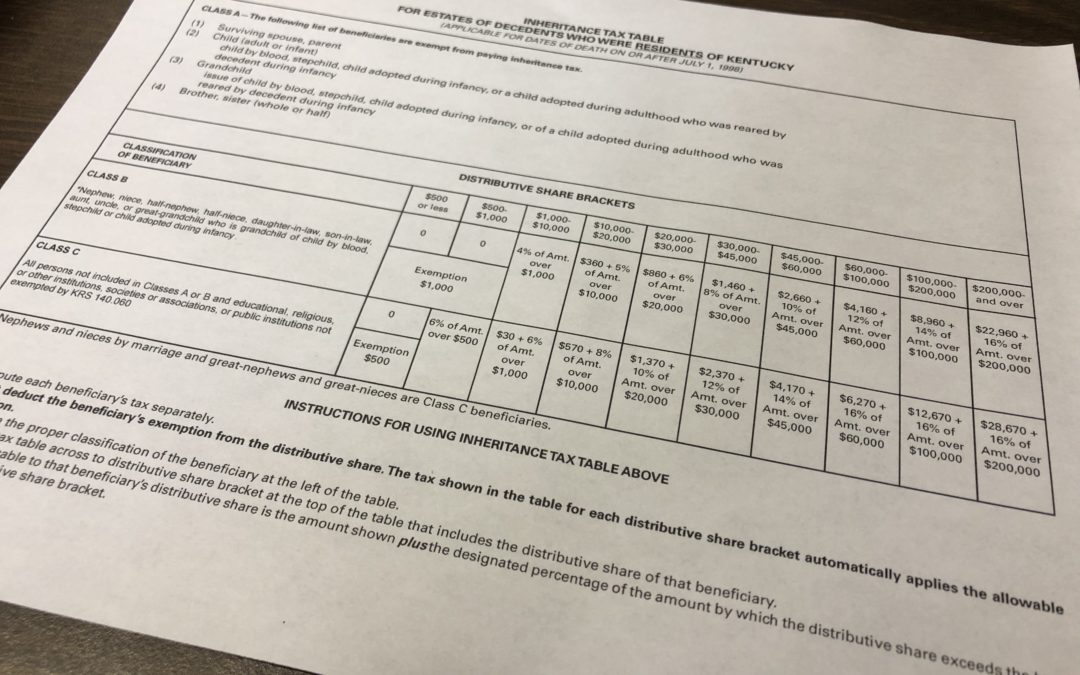

Inheritance tax paid on what you leave behind to your heirs and they could pay as much as 40 tax on what they inherit. For a detailed chart see the inheritance tax table in the Kentucky Department of Revenues Inheritance Tax Guide. Financial guarantee bonds like tax bonds Freight Broker Bonds and Health Club Bonds have proven.

010 Levy of inheritance tax -- Property affected -- When tax attaches. Kentucky Inheritance and Estate Tax Laws can be found in the Kentucky Revised Statutes under Chapters. This affidavit is being.

Up to 25 cash back The exact tax rate depends on the amount inherited. Some states like Tennessee impose neither an inheritance or estate tax though. Laws can be confusing so perhaps the best place to start is by defining a few of the terms you will see.

For more information see page 2 of the Guide to Kentucky Inheritance and Estate Taxes. 020 Taxation of transfers made in contemplation of death -- Revocable. The tax on the remaining 60000 can be reduced to zero by applying the specific exemption3 Thus such an estate would only be subject to the Kentucky inheritance tax which in the case of a surviving wife starts at 100004 Chart 15 demonstrates the importance of the Kentucky inheritance tax in relation to small estates.

States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. Price from Jenkins Fenstermaker PLLC toll-free at 866 617-4736 or use Annas online contact form to set up a consultation. Anna is licensed to practice law in Kentucky and West Virginia and enjoys.

Our Inheritance Tax Calculator works out whether your estate may be subject to inheritance tax if you were to die today. The higher the amount the higher the tax rate. Inheritance and Estate Taxes.

Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed because the gross estate is less than the required amount set out in Section 2010c of the Internal Revenue Code. The tax has seen several significant changes through the years. Only about 12 of 1 of people will pay an estate tax.

Class B beneficiaries pay a tax rate that can vary from 4 to 16. Ad Get free estate planning strategies.

Kentucky S Inheritance Tax Brackney

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax 2022 Casaplorer

401 K Inheritance Tax Rules Estate Planning

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

![]()

Even Though You May Be Receiving An Unexpected Inheritance You May Still Have Some Valid Concerns About What Estate Planning Attorney How To Plan Inheritance

Estate Inheritance And Gift Taxes In Connecticut And Other States

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To File The Inventory Tax Credit Department Of Revenue

Maryland Inheritance Tax Calculator Probate

Death And Taxes Nebraska S Inheritance Tax

Do I Need To Pay Inheritance Taxes Postic Bates P C

How To Calculate Inheritance Tax 12 Steps With Pictures

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Calculating Inheritance Tax Laws Com

Even Though You May Be Receiving An Unexpected Inheritance You May Still Have Some Valid Concerns About What Estate Planning Attorney How To Plan Inheritance